Oil prices fell to another multiyear low on Monday following more troubling financial news.

The price of Brent crude oil, considered the benchmark for global oil prices, fell to $70.12 a barrel — the lowest price since early December 2021, according to market data.

Why it matters: The fall in oil prices follows upheaval in the global financial system. Earlier this month, the American banks Silicon Valley Bank and Signature Bank failed and were closed by authorities. The Silicon Valley Bank’s failure was particularly troublesome for the relatively high number of Israeli tech startups that had money with the bank. The US government has said it will guarantee deposits at both banks.

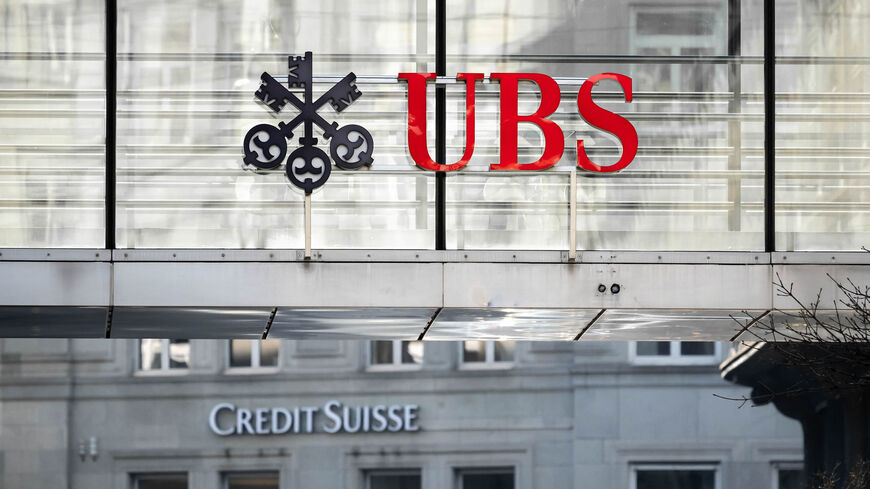

Last week, the global investment bank Credit Suisse’s shares plummeted. UBS, another Swiss Bank, agreed on Sunday to buy Credit Suisse for $3.2 billion.

The Saudi National Bank owns just under 10% of Credit Suisse and lost around 80% of its investment in the ordeal, amounting to more than $1 billion. The Riyadh-based bank said its strategy will remain the same following the acquisition, CNBC reported on Monday.

Brent crude oil also fell below $75 last week, which was likewise a 15-month low.

Know more: An oil spill occurred in Kuwait on Monday, prompting the country to declare a state of emergency, the official Kuwait News Agency reported.

What’s next: The Federal Reserve will decide on Wednesday what to do about interest rates. Oil prices tend to fall when the monetary institution raises rates. The Silicon Valley Bank collapse was prompted in part by the Fed's rate hikes targeting inflation over the past year, as tech startups became more risk aggressive due to more expensive borrowing.

The Saudi-led OPEC+ alliance will meet again April 3 to discuss production levels. The cartel has maintained its 2 million barrels per day supply cut since last November.