Should the US worry about China's expanding influence in the Gulf?

Al-Monitor Pro Members

Dr. Karen E. Young

Senior Research Scholar, Center on Global Energy Policy, Columbia University

May 2, 2023

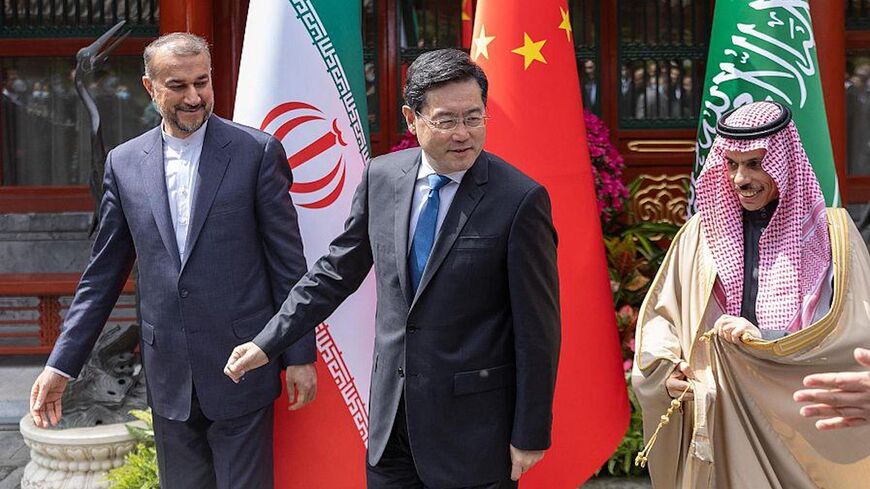

China's hosting of a diplomatic breakthrough in the planned resumption of diplomatic ties and embassy operations between Iran and Saudi Arabia signals a different kind of Chinese interest and willingness to engage in the politics of the Persian Gulf. But China's presence in the Gulf remains largely of an economic nature, with a concern for its energy supply, and a political interest in furthering a support of alternate development models to Western democratic liberalism. If China were to ramp up its regional military and security capabilities, they are more likely to intensify a presence along the African side of the Red Sea corridor and could become a challenge to Gulf interests, as well as to the United States. There is the risk of a broader political schism globally, in which the United States and China are in conflict and low and middle-income economies center around a non-aligned majority that rejects both a democracy club and Chinese domination. In the interim, however, the Arab side of the Gulf remains culturally much more American than Chinese in orientation. But among the ruling elite of the Gulf, a fear of US selective sanctions targeting political leadership and their assets, along with G7 coordinated economic tools like the price cap on Russian oil, make China an attractive interlocutor, though not yet a replacement for the role the United States has played since at least the late 1970s in the region.

China's economic interests in the Arab side of the Gulf are substantial, in purchases of oil and gas exports and in general trade (much of it re-export) through the region and its waterways, especially through the Red Sea corridor. The investment interests of China in the Gulf are less well understood. China is an important source of contracting and foreign direct investment in a few key states and in a few key sectors across the Middle East North Africa and Pakistan (MENAP): the United Arab Emirates, Saudi Arabia, Egypt, Turkey and in Pakistan. But even in Egypt, Pakistan and Turkey, the GCC states are often more important sources of greenfield foreign direct investment, job creation and financial intervention via central bank deposits and direct support. China's interests in Iran are consequential but leave a lot to be desired from the Iranian side in attracting investment and development finance.

For these reasons, an incipient Gulf-China affinity is more a product of a customer service relationship in the oil trade and geopolitical shifts more than shared political ideology, and not a substantial security partnership. The trendline of newer oppositional economic development models to the US-dominated liberal order led by China and the Gulf states within low and middle-income economies, however, is sure to have more lasting institutional and domestic political consequences in the decade to come. And while their models are similar, they are not the same, and in the MENAP geography, it is the Gulf states that often dominate. Within the GCC, Chinese investment and contracting awards are most visible in Saudi Arabia and the United Arab Emirates.

- Together, China and the Gulf Arab states are increasingly the most important source of credit to lower and middle-income countries (LMICs). According to World Bank debt reporting, at the end of 2021, the GCC countries held roughly $55 billion of official credit stock to LMICs, though this does not include recent loans and central bank deposits to Egypt in 2022, roughly an additional $15 billion. Egypt is by far the largest recipient of Gulf financial intervention, and Gulf support (in loans and central bank deposits) is concentrated in MENAP, whereas Chinese lending is more widespread across Asia, Africa and Latin America.

- In Egypt, the GCC states have been a consistent and dominant source of capital.

- Chinese capital investment and contracting across MENA accelerated after 2014 in the number of projects, and is most concentrated in the Gulf (mostly UAE) by volume of projects.

- Chinese capital investment by project volume across sectors and country destinations in MENAP from 2003-2023 (Q1) has been most concentrated in the UAE, with Egypt, Pakistan, Turkey and Saudi Arabia following by half the number of projects. Building materials and contracting, along with heavy industry, carbon energy projects (coal, oil and gas), and electronic components were the most common types of sectoral engagements across these recipient countries, though the UAE and Turkey also had substantial consumer product investments.

- In Saudi Arabia, within the megaprojects of Vision 2030, Chinese contracting firms continue to win awards, but they are among many local and multinational competitors. For example, according to data from MEED, of the top 20 contractors awarded work in NEOM, there are at least two awards to Chinese contractors in power and water utilities, but they are not the largest awards by far. The latest major investment from China has been by Baosteel in a joint venture with the PIF and Saudi Aramco to build a steel plant to construct materials for oil platforms and ship hulls.

Scenario 1: China may decide to expand its political footprint as an interlocutor in regional conflict resolution.

China is not a neutral actor across the Middle East and Gulf region and has the capacity to exert leverage on those states that seek its financial support and rely on its energy imports. China's investments in the Gulf are concentrated in the UAE and Saudi Arabia, much less so in Iran. China is also not dependent on Iranian, Saudi or even Omani oil exports or Qatari gas exports in the way that these producers are dependent on China as an export market.

In this scenario, China might try to project more soft power within the Gulf as a way to challenge the United States, but more broadly to showcase its ideal of economic development as security. China may find it difficult to produce results in shared economic growth and in political stability, as the region itself may have different ideas of sustaining conflict through third parties, as Iran has done in Yemen, Syria and Lebanon. Iran's military operations in the Persian Gulf, with attacks and seizing of oil cargo vessels, may also directly challenge Chinese diplomatic interventions.

Scenario 2: Chinese and Gulf interests and mutual dependence gradually diverge over time.

As China's domestic oil demand declines over the longer term because of shifts in its transport sector and in its domestic electricity generation, its attention to the Middle East and especially the Gulf could wane. Likewise, the need for an intense contracting awards cycle to deliver domestic infrastructure projects in the Gulf will soon slow, as projects like Vision 2030 come to completion or are scaled back.

Besides its contracting presence, Chinese investment in the Gulf has focused on the energy sector in both traditional hydrocarbon refining and petrochemical facilities, but also in renewables and the supply of solar power technology. Nascent Gulf solar industries may eventually be locally sufficient and no longer depend on China.

This scenario depends on the pace of the energy transition away from carbon reliance in China, and the scale of economic growth driven by state investment plans in the Gulf (especially in Saudi Arabia). Both could lead to a significant decline of the Gulf-China economic relationship.

Scenario 3: A global conflict between China and the United States forces the Gulf states to choose sides.

In the short term, the level of US security integration into Gulf military operations would push the Gulf Arab states to depend upon a US security umbrella for their domestic security, but also for the security of their energy exports.

All three scenarios are possible over time, but in the short term, we are likely to see the experimentation of Scenario 1, in which China expands its political and diplomatic presence in the Gulf, more as an interlocutor and host of discussions. China likely has significant leverage over Iran, but may be shy to use it. In the event of a flare-up of tensions, China is likely to look ineffective as a conflict mediator.

Karen E. Young is a senior research scholar at the Center on Global Energy Policy at Columbia University. She was previously founding director of the Program on Economics and Energy at the Middle East Institute. She was a resident scholar at the American Enterprise Institute, and taught courses on the international relations and economy of the Middle East at George Washington University and at the Johns Hopkins School of Advanced International Studies. Before joining AEI, she served as senior resident scholar at the Arab Gulf States Institute, a research and visiting fellow at the Middle East Centre of the London School of Economics and Political Science, and an assistant professor of political science at the American University of Sharjah in the UAE.

We're glad you're interested in this memo.

Memos are one of several features available only to PRO Expert members. Become a member to read the full memos and get access to all exclusive PRO content.

Already a Member? Sign in

The Middle East's Best Newsletters

Join over 50,000 readers who access our journalists dedicated newsletters, covering the top political, security, business and tech issues across the region each week.

Delivered straight to your inbox.

Free

What's included:

Free newsletters available:

- The Takeaway & Week in Review

- Middle East Minute (AM)

- Daily Briefing (PM)

- Business & Tech Briefing

- Security Briefing

- Gulf Briefing

- Israel Briefing

- Palestine Briefing

- Turkey Briefing

- Iraq Briefing

Premium Membership

Join the Middle East's most notable experts for premium memos, trend reports, live video Q&A, and intimate in-person events, each detailing exclusive insights on business and geopolitical trends shaping the region.

$25.00 / month

billed annually

$31.00 / month

billed monthly

What's included:

Memos - premium analytical writing: actionable insights on markets and geopolitics.

Live Video Q&A - Hear from our top journalists and regional experts.

Special Events - Intimate in-person events with business & political VIPs.

Trend Reports - Deep dive analysis on market updates.

We also offer team plans. Please send an email to pro.support@al-monitor.com and we'll onboard your team.

Already a Member? Sign in